The global financial landscape has been undergoing a transformation, driven by a clear consumer shift towards cashless transactions. As digital payments become the consumer preference, businesses are compelled to integrate them to cater to modern spending habits. This surge in digitisation presents a significant opportunity for fintech companies. By offering comprehensive financial solutions to businesses, including solutions for payment gateway, cross-border money transfers and currency exchange, their business finance operations can be streamlined. In addition, where companies, in particular money exchange operators provide money service (as defined below), it is important for these fintech companies to navigate the regulatory environment in Hong Kong. For consumers, they should use money services provided by licensed Money Service Operators (“MSO”). Recent cases illustrated how consumers fell victim to unlicensed MSO when transferring funds from Hong Kong to mainland China. In these schemes, a third party (rather than the MSO itself) transferred the funds to the consumer’s mainland bank account. Unknowingly, the consumer thereby facilitated money laundering by lending legitimacy to the illicit transfer.

This article aims to provide an overview of the regulatory framework for MSO as well as the MSO licensing application process in Hong Kong.

Regulatory Framework for MSO

The Anti-Money Laundering and Counter-Terrorist Financing Ordinance (Cap. 615 of the Laws of Hong Kong) (the “AMLO”) establishes a regulatory framework for money service operators, which falls under the remit of the Hong Kong Commissioner of Customs and Excise (“CCE”).

As mentioned above, fintech companies or other companies may need to assess whether an MSO licence should be obtained if their business model provides money service. As defined under Part 1 of Schedule 1 to the AMLO,

- “money service” means a “money changing service” or a “remittance service”;

- “money changing service” means a service for the exchanging of currencies that is operated in Hong Kong as a business (but does not include such a service operated by a person who manages a hotel under certain conditions); and

- “remittance service” means a service of one or more of the following that is operated in Hong Kong as a business – (i) sending or arranging for the sending of, money to a place outside Hong Kong, (ii) receiving, or arranging for the receipt of, money from a place outside Hong Kong and (iii) arranging for the receipt of money in a place outside Hong Kong.

In view of the above, fintech companies or other companies whose business models involve any element of money changing and/or remittance should evaluate whether their business activities fall within the statutory definitions and consequently require an MSO licence to operate in compliance with Hong Kong law.

Legal Consequences of Non-Compliance

If a person operates money service without an MSO licence, such person commits an offence under the AMLO. Further, under the AMLO, a person who operates money service without an MSO licence is liable for the following: –

- On conviction on indictment to a fine of HK$1,000,000 and to imprisonment for 2 years; or

- On summary conviction to a fine at level 6 and to imprisonment for 6 months.

Exemptions

It is worth noting that under the AMLO, the MSO licensing requirement does not apply to the following entities and activities:

- Government entity

- Authorised institution carrying on banking businesses under the Banking Ordinance (Cap. 155 of the Laws of Hong Kong)

- A licensed corporation operating a money service ancillary to its principal business under the Securities and Futures Ordinance (Cap. 571 of the Laws of Hong Kong)

- An authorised insurer operating a money service ancillary to the insurer’s principal business under the Insurance Companies Ordinance (Cap. 41 of the Laws of Hong Kong) (“Insurance Companies Ordinance”)

- An authorised insurance broker operating a money service which is ancillary to the broker’s principal business under the Insurance Companies Ordinance

- An appointed insurance agent operating a money service ancillary to the agent’s principal business under the Insurance Companies Ordinance

- A stored value facility licensee operating a money service ancillary to the licensee’s principal business under the Payment Systems and Stored Value Facilities Ordinance (Cap. 584 of the Laws of Hong Kong) (the “PSSVFO”)

- A system operator or settlement institution of a designated retail payment system operating a money service which is ancillary to its business as a system operator or settlement institution under the PSSVFO

In addition, the Money Service Operators Licensing Guide issued by the Customs and Excise Department (the “C&ED”) specifies that a money changing service means a service for exchanging of currencies that is operated in Hong Kong as a business, but does not include such a service that is incidental to the main business. In recent years, we have been approached by payment solutions companies seeking legal advice as to whether their business models (e.g. the involvement of dynamic currency conversion (DCC) in payment solutions) would fall within the ambit of money service business. Case law shows that the need for an MSO licence is highly fact-specific, and each case is evaluated on its own merits. It is therefore important for businesses to seek legal advice if they have any doubt before carrying on businesses where money changing or remittance may be involved.

MSO Licensing Application Process

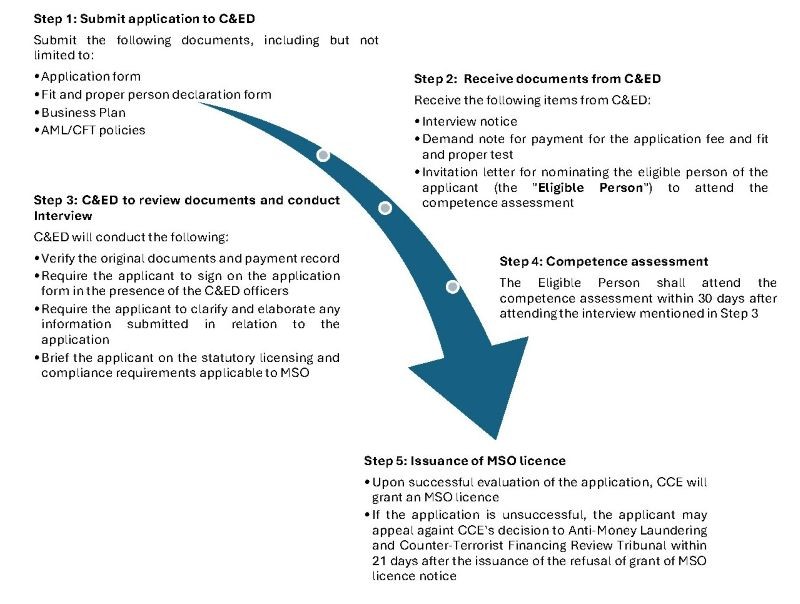

If a company carries on a business of money changing and/or remittance and does not qualify for any of the exemptions above, it is likely that the company will need to apply for an MSO licence with the C&ED. For illustration purposes, below is a flowchart summarising the major steps of the application process for an MSO license application:

The processing time for MSO licensing application may vary and depend on various factors, such as the time for the collection of requisite documents and information from the applicant, on-site inspection at the business premises, the time required for C&ED to conduct the fit and proper person test, and the time taken for completing the competence assessment. The entire processing time for MSO licensing application is expected to take at least 3 months. This timelime may be further extended if C&ED raises any further enquiries or concerns in relation to the application.

Conclusion

Pursuing an MSO licence in Hong Kong opens the door to a vibrant financial marketplace. Navigating the application process successfully requires a clear understanding of its requirements and good preparation. In addition, consumers should only use money services provided by licensed MSOs and avoid using remittance services provided from unlicensed MSOs that offer unreasonably low fees, which can be a potential red flag for money laundering or other illicit activities.

If you have any questions or require legal assistance on the subject matter, please feel free to contact our team and we will be happy to assist you.